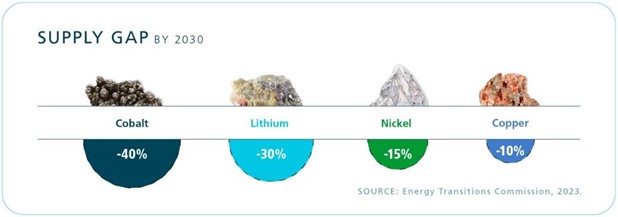

Battery industry must prepare for significant deficits in key minerals such as copper, nickel, lithium, and cobalt, with the shortfalls ranging from 10% to 40%.

As nations strive to reduce carbon emissions and combat climate change, the transition to clean energy has been heralded as one of the most pressing imperatives of our time.

Electric vehicles (EVs) and energy storage capacities have emerged as a beacon of hope, promising a future of sustainable transportation powered by renewable energy. However, beneath the surface of this narrative lies a significant challenge: the looming supply gap of battery minerals, according to Sprott, a Toronto-based global asset manager providing clients with access to highly-differentiated precious metals and real assets investment strategies.

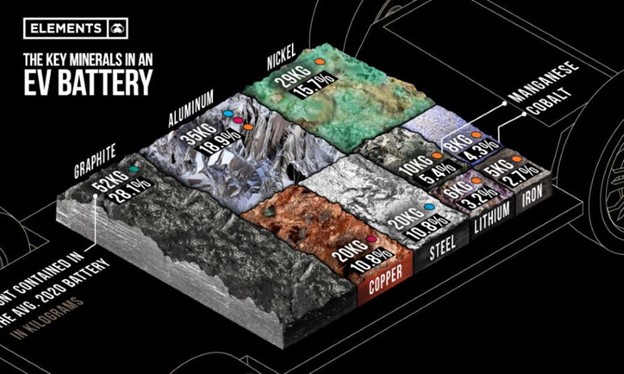

Battery minerals, including copper, cobalt, lithium, nickel, graphite, and manganese, serve as the backbone of modern energy storage systems.

Minerals used in the manufacturing of batteries.

These metals are indispensable for the production of lithium-ion batteries, which power EVs and store renewable energy generated from sources like solar and wind. As the world races towards decarbonization, the demand for these critical minerals is set to skyrocket, driven primarily by the exponential growth of the electric vehicle market.

According to projections based on a Net Zero Emissions Scenario (NZE), the demand for battery metals is expected to experience a seismic surge by 2040. Copper, cobalt, lithium, nickel, graphite, and manganese will witness staggering increases in demand, outstripping current usage by orders of magnitude, as shown by Sprott’s calculations in the graphic below:

Thus, demand for copper will increase by 241%, for cobalt by 278%, manganese +704%, graphite +721%, nickel +843%, and lithium +1,519%.

This surge reflects the pivotal role that these minerals play in enabling the transition to a low-carbon economy.

However, the rosy outlook for clean energy is clouded by the specter of a supply gap, with predictions indicating shortages as early as 2030. The Energy Transitions Commission (ETC), a think tank, warns of significant deficits in key minerals such as copper, nickel, lithium, and cobalt, with the shortfalls ranging from 10% to 40%:

The implications of a battery mineral supply gap are far-reaching – not only could it disrupt the momentum of the clean energy transition, but it could also exacerbate geopolitical tensions as nations vie for control over scarce resources. Moreover, supply constraints may hamper the affordability and accessibility of EVs, hindering efforts to decarbonize transportation effectively, Sprott emphasizes.

Despite these challenges, the supply gap also presents opportunities for investment and innovation. The burgeoning demand for battery minerals is driving interest in mineral exploration and mining companies, poised to capitalize on the growing market.